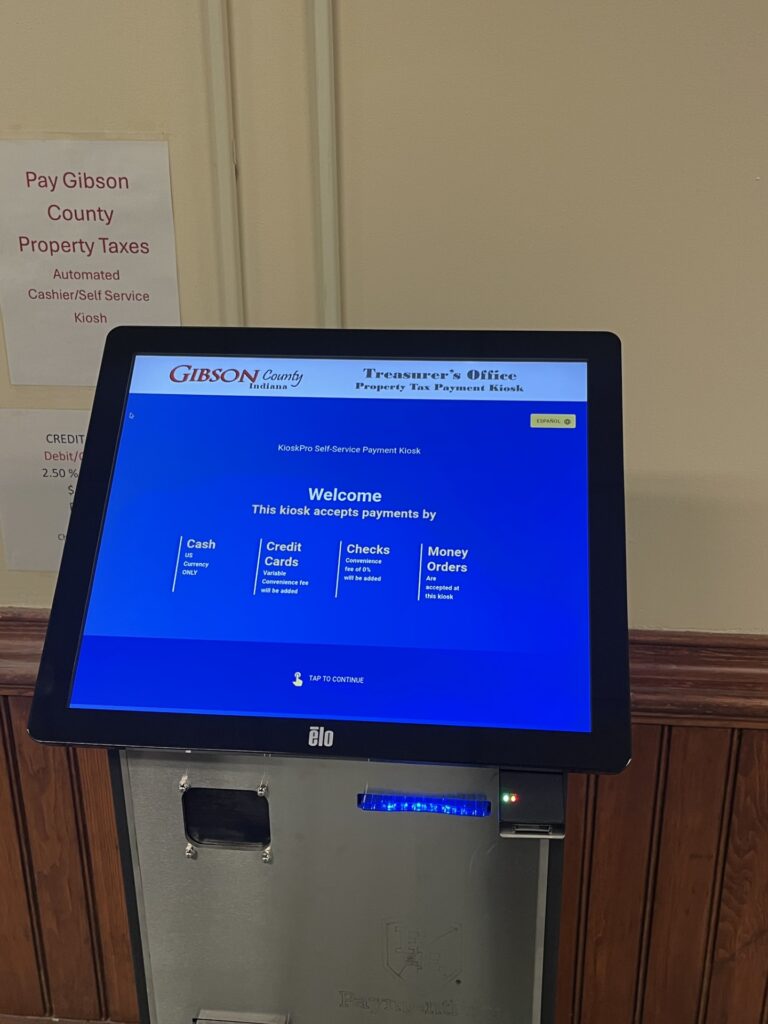

The new Kiosh is located in the basement of the Gibson County Courthouse, just outside the Assessor’s Office.

Gibson County Treasurer’s Office announces that tax bills for Spring and Fall Installments of Gibson County Property Taxes will be mailed to property owners beginning the first week of April 2025. Property Tax bills can be viewed at our software website at lowtaxinfo.com.

Spring Installment for property taxes will be due by Monday, May 12, 2025. Fall Installment will be due by Monday, Nov. 10, 2025. No other bills will be mailed. A late Payment Penalty will be assessed if payment is made after the deadline. Complete information will be included on the Property Tax remittance coupon. Payment must be postmarked by the due date. Property tax bills will also be available for viewing on our new software website of LOWtaxinfo.com and clicking on Gibson County.

The Gibson County Treasurer’s office is proud to announce that a new automated self-service KIOSH is available in the basement of the Courthouse for Property Tax payments. Patrons will be able to search for the Property tax balances, pay and receive a printed receipt. Property owners may pay with cash, credit/debit card, e-check, personal check, or money order.

As per usual, Property Tax Payments can be made in-person in the Gibson County Treasurer’s Office. Please bring your coupons with you when paying to avoid waiting. Payments can also be made using the United State Post Office by using the enclosed coupons and an envelope addressed to the Treasurer of Gibson County. If paying by mail please include tax coupons and if you would like a receipt, please enclose a self-addressed, stamped envelope.

A drop box for taxpayer convenience is also located on the Northeast corner of the courthouse by the lower-level entrance. Please deposit payment with tax coupons by check, no cash. Your cancelled check will be your receipt of payment.

Payments can also be made by using Debit/Credit Card through GovTech by phone by calling 1 (844) 882-3395, online at www.govtechtaxpro.com. Your 18-digit parcel number will be required. An additional 2.50% user fee and $1.50 Transaction Fee will apply. Payment to GovTech by e-check will carry a charge of $2.00.

For question about property tax assessments, please call the Gibson County Assessor’s Office at 812-385-5286. For questions on your property tax bill, please feel free to call the Gibson County Treasurer’s Office at 812-385-2540. For questions about exemptions and address changes, please call the Gibson County Auditor’s Office at 812-385-4927.

Ian O’Neal, property owner from Fort Branch, checking out the new service provided by Gibson County and the Treasurer’s Office.

Property owners are able to search their property taxes for 24 pay 25, with the options of paying by cash, check, money order for credit/debit card.

Open Monday – Friday

8:00 am – 4:00 pm

Closed Daily 11:15 am – 12:30 pm

Closed on all National Holidays